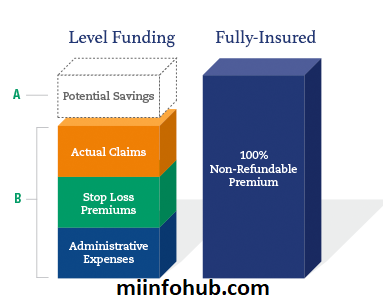

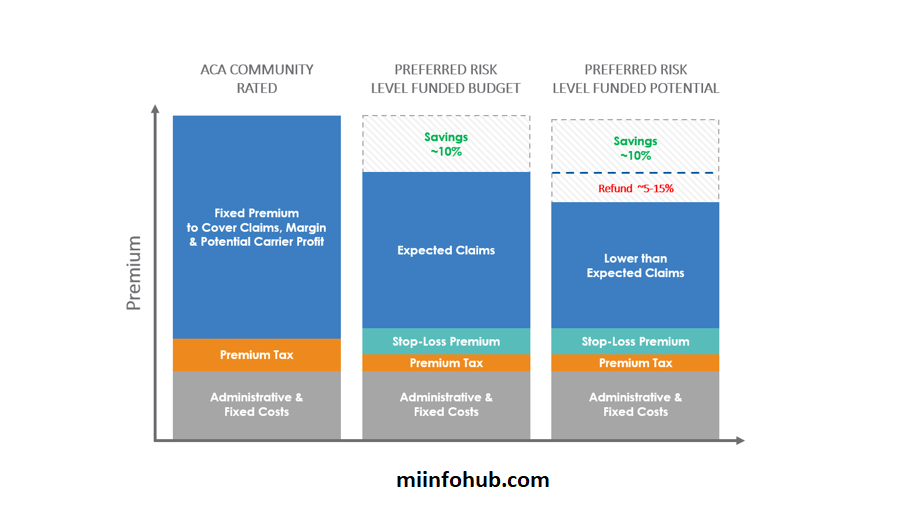

A level-funded health plan is a hybrid between fully-insured and self-funded health insurance, offering businesses a middle ground between the two. It combines the predictability of a fully-insured plan with the cost-saving potential of a self-funded model. Employers pay a fixed monthly amount, which covers expected claims, stop-loss insurance, and administrative fees. This provides businesses more control over their health benefits while limiting the financial risk typically associated with self-funding.

Level-funded plans are particularly appealing to small and mid-sized companies that want to reduce costs without taking on full risk exposure. These plans are designed to offer stability in monthly payments while giving employers the opportunity for refunds if claims are lower than expected. For companies with healthier employee populations, the potential for savings is significant.

How Does Level Funded Health Plan Work?

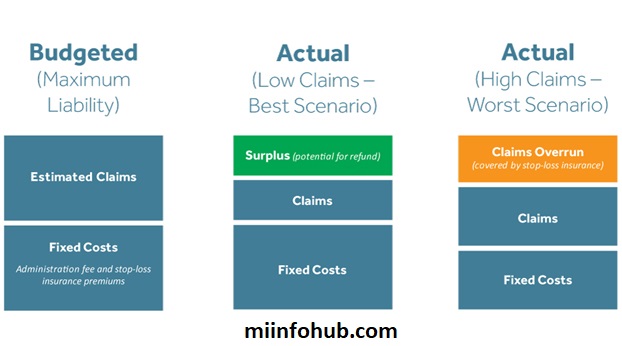

In a level-funded plan, employers pay a fixed monthly amount, which is designed to cover several key components: claims, stop-loss insurance, and administrative costs. This set amount provides predictability, allowing businesses to budget for their healthcare expenses more easily. Unlike fully-insured plans where premiums are fixed and no savings are returned, level-funded plans offer the potential to save money if actual claims come in lower than expected. If u are intrusted about pos health plan then click here.

The monthly payment includes:

Administrative Costs: Covers fees for plan management, claims processing, and other administrative functions, often handled by a third-party administrator.

Claims Funding: A portion of the payment goes towards anticipated employee healthcare claims.

Stop-Loss Insurance: This protects businesses from unexpectedly high claims by covering any expenses that exceed a predetermined threshold.

Key Features Of Level Funded Health Plan

- Fixed Monthly Payments: Employers pay a set, predictable amount each month, similar to how premiums work in fully-insured plans. This fixed payment helps in budgeting and eliminates the risk of fluctuating costs throughout the year.

- Stop-Loss Insurance: A crucial element of level-funded plans, stop-loss insurance protects employers from unusually high claims. If an employee’s medical expenses exceed a certain threshold, stop-loss coverage kicks in, preventing the company from facing excessive financial burdens.

- Claims Review and Refunds: One of the attractive features of a level-funded plan is the possibility of receiving a refund. At the end of the year, if actual claims are lower than what was estimated, the company may receive a portion of the unused claims fund, creating potential savings.

- Flexible Benefits: These plans often allow employers to customize benefits based on the specific needs of their workforce. This flexibility makes it easier for companies to design a healthcare plan that aligns with employee preferences while managing costs effectively.

Benefits Of A Level Funded Health Plan

- Predictable Costs: One of the main advantages of a level-funded plan is the stability it provides in terms of cost. Employers pay a fixed monthly amount, reducing the uncertainty that often comes with variable healthcare expenses. This predictability allows for more accurate budgeting and financial planning throughout the year.

- Refund Potential: If actual healthcare claims come in lower than expected, employers have the opportunity to receive a refund. At the end of the plan year, unused funds from the claims portion may be returned, providing potential savings. This refund potential is one of the key differentiators from fully-insured plans, where excess premiums are kept by the insurer.

- Customization: Level-funded plans offer more flexibility than traditional fully-insured plans. Employers can design the plan to better meet the needs of their employees by tailoring coverage options, benefits, and even wellness programs. This customization ensures that companies can provide meaningful healthcare benefits while keeping costs under control.

- Data Transparency: Employers receive regular reports detailing employee healthcare usage and claims data. This transparency allows businesses to make informed decisions about their health plan, adjusting coverage as needed, and implementing wellness initiatives to improve employee health and reduce future claims.

How To Set Up Level Funded Health Plan?

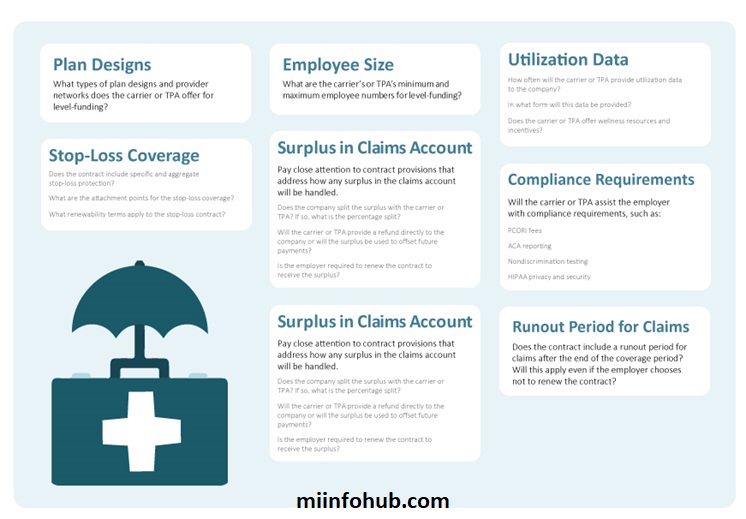

- Select a Provider: The first step is choosing an insurance carrier or third-party administrator (TPA) that offers level-funded health plans. It’s essential to evaluate their reputation, services, and expertise in managing these types of plans.

- Determine Coverage: Assess the healthcare needs of your employees and decide on the types of coverage to include, such as medical, dental, vision, and prescription benefits. Tailoring the coverage to fit your workforce’s demographics can help control costs while providing essential services.

- Work with a Broker: Collaborate with a health insurance broker who specializes in level-funded plans. A broker can guide you through the setup process, ensuring the plan is structured correctly, aligns with your company’s goals, and adheres to regulatory requirements.

- Review Stop-Loss Insurance: Understand the details of the stop-loss insurance, which is a critical component in protecting your business from large, unexpected claims. Work with your broker to set appropriate limits that balance risk and cost while ensuring sufficient coverage.

Who Should Consider Level Funded Health Plans?

Level-funded health plans are well-suited for companies with relatively healthy employees. These plans work best for businesses that are looking for more flexibility and control over their healthcare benefits without assuming the full financial risk of a self-funded plan. By offering predictable costs and potential refunds, level-funded plans are particularly attractive to companies that can manage their claims efficiently.

Small to mid-sized businesses, typically with 10 to 100 employees, often find these plans beneficial. Employers who want to provide robust health coverage while potentially saving money on claims will see the most advantage. If your workforce tends to have lower healthcare utilization, this plan could help reduce overall costs and provide financial rewards at year-end.

Is A Level-Funded Plan Right For Your Business?

To determine if a level-funded plan is the right fit for your organization, consider the following factors:

Company Size

- Level-funded plans are ideal for small to mid-sized businesses, typically with 10 to 100 employees. This size allows effective risk spreading while enjoying predictable costs and potential refunds.

Employee Demographics

- Understanding your workforce’s health profile is essential. Companies with healthier employees tend to have lower healthcare costs, making them strong candidates for level-funded plans. Fewer medical claims can lead to significant savings.

Financial Health

- Evaluate your company’s financial stability before committing. While level-funded plans offer predictable costs, risks remain. Ensure your organization can manage potential claims, handle unexpected spikes in healthcare expenses, and afford the necessary stop-loss insurance for added protection.

Compliance And Regulations

Level-funded health plans are subject to various state and federal regulations, which include the following:

Affordable Care Act (ACA)

- Level-funded plans may need to adhere to certain ACA provisions, though exemptions can exist based on state regulations. Plans meeting specific criteria might not have to comply with all ACA requirements, such as the essential health benefits mandate. Employers must understand their state’s ACA implications to ensure compliance.

ERISA (Employee Retirement Income Security Act)

- Level-funded plans are required to follow ERISA regulations, which set minimum standards for employee benefit plans. ERISA ensures employees receive necessary information about their benefits and protections. It mandates fiduciary standards, financial reporting, and information regarding participants’ rights and claims procedures.

State Regulations

- Each state may impose additional requirements for level-funded plans, including licensing, reporting, and specific mandates. Employers should consult legal or insurance experts to effectively navigate these regulatory requirements.

Differences Between Fully-Insured And Level-Funded Plans

Fully-Insured Plans

- In a fully-insured plan, the insurance company bears all financial risk related to healthcare claims. Employers pay a fixed premium, covering all medical expenses for employees, which ensures cost predictability throughout the year. However, this model limits customization of benefits and does not allow for refunds if claims are lower than expected.

Level-Funded Plans

- Level-funded plans share risk between the employer and insurer. Employers pay a fixed monthly amount that covers expected claims, stop-loss insurance, and administrative costs. If actual claims are lower than anticipated, employers may receive a refund at the year’s end. This model offers greater flexibility in plan design and allows for tailored benefits, making it particularly advantageous for companies with a relatively healthy workforce.

Advantages Of Level-Funded Plans Over Fully-Insured Plans

Cost Savings

- Level-funded plans offer significant potential for cost savings. If healthcare costs are lower than expected, employers may receive refunds at the end of the plan year, allowing them to retain unspent funds. By managing claims effectively and promoting preventive care, companies can maximize these financial benefits.

Customization

- These plans provide greater flexibility than fully-insured options. Employers can tailor benefits to fit their workforce’s needs, such as incorporating wellness programs or selecting different coverage levels. This customization boosts employee satisfaction and engagement by addressing individual needs.

Transparency

- Employers enjoy increased transparency with level-funded plans. Detailed reports on claims, healthcare usage, and costs empower businesses to make informed decisions about their health benefits. This insight helps identify trends, assess the effectiveness of healthcare initiatives, and refine strategies to optimize spending and improve employee health outcomes.

Real-Life Examples

Here’s how some companies have benefited from implementing level-funded plans:

Example 1: Small Tech Company

- A small tech company with 50 employees switched from a fully-insured plan to a level-funded plan after assessing their healthy workforce. This change resulted in a 15% savings on premiums, which they reinvested into employee wellness programs, enhancing overall satisfaction. The fixed monthly payments provided better budget management and financial predictability.

Example 2: Mid-Sized Manufacturer

- A mid-sized manufacturing firm with 150 employees chose a level-funded plan to control costs. Unfortunately, they faced unexpectedly high claims due to serious health issues. Although they didn’t achieve savings, the flexibility of the level-funded plan allowed them to customize their benefits package with services like telehealth and wellness incentives. This adaptability ultimately improved employee morale and health outcomes, proving beneficial in the long term.

Comparison With Self-Funded And Fully-Insured Plans

| Feature | Fully-Insured Plan | Self-Funded Plan | Level-Funded Plan |

|---|---|---|---|

| Risk | Insurance company assumes | Employer assumes | Shared risk with stop-loss |

| Monthly Payments | Fixed premiums | Variable based on claims | Fixed payments + potential refund |

| Flexibility | Limited | High | Moderate |

| Refund Potential | No | Yes | Yes, if claims are lower |

Drawbacks To Consider

- RRisk: While level-funded plans can provide cost savings, they carry inherent risks. If claims exceed expectations, employers may not only miss potential savings but also incur higher costs. This risk is especially relevant for companies facing fluctuating health trends or unforeseen health crises. Thorough risk assessments and understanding the workforce’s health profiles are essential before committing to a level-funded plan.

- Complexity: Managing a level-funded plan can be more complex than a fully-insured plan. Employers must navigate components like stop-loss insurance, claims management, and regulatory compliance. This complexity often necessitates additional resources or the help of third-party administrators and brokers to ensure effective plan management. Companies lacking adequate administrative support may struggle to implement and oversee these plans.

- Suitability: Level-funded plans may not suit all businesses. Companies with high-risk workforces, such as those in physically demanding industries or with above-average health issues, might find fully-insured plans more appealing due to their financial predictability. Evaluating workforce demographics and health risks is crucial before making a decision.

Future Trends in Level-Funded Plans

The healthcare landscape is constantly evolving, and level-funded plans may adapt in the following ways:

- Use of Technology: Data analytics tools will transform how employers manage level-funded plans by providing insights into claims patterns and employee health trends. These tools enable employers to identify improvement areas, promote preventive care, and make informed healthcare decisions, ultimately enhancing risk management and employee health outcomes.

- Increased Customization: As workforce demographics diversify, the demand for flexible benefits will grow. Level-funded plans may offer more customizable options, allowing employers to tailor benefits packages to meet their employees’ unique needs. This could include expanded health coverage, wellness initiatives, and mental health services, boosting employee engagement and satisfaction.

- Cost Containment: With rising healthcare costs, employers will adopt cost-containment strategies within level-funded plans. This may involve integrating telemedicine for remote healthcare access and investing in wellness programs that promote preventive care, helping to lower overall expenses and manage costs effectively.

Frequently Asked Questions (FAQs)

Can a small company use a level-funded plan?

Yes, even small businesses with as few as 10 employees can benefit.

What happens if claims are higher than expected?

Stop-loss insurance covers any excessive claims, protecting the company from financial loss.

Are level-funded plans regulated?

Yes, they are subject to certain state and federal regulations, depending on the location.

How do level-funded plans affect employee experience?

Employees may not notice much difference from a traditional plan, but employers have more control over benefits.

How can businesses handle claims under a level-funded plan?

Claims are usually processed through a third-party administrator who manages the healthcare payments.

Conclusion

A level-funded health plan offers the best of both worlds: control and potential savings with predictable monthly costs. Companies with healthy employees looking for flexibility and cost efficiency may benefit the most. However, it’s crucial to weigh the risks and complexity before deciding.

By understanding what level-funded health plans are and how they work, businesses can make smarter decisions regarding healthcare benefits. These plans can help reduce overall costs while providing flexibility and data transparency.